JSMedia – When choosing an auto insurance policy, it’s important to understand what each coverage includes. In addition to providing financial and liability protection, auto insurance also protects the driver and others in the event of an accident. Even at 70 mph, an automobile can cause a significant amount of damage to pedestrians or other vehicles. Additionally, car insurance can help protect you from lawsuits resulting from automobile-related accidents. Fortunately, IMT auto insurance covers many common aspects of car insurance. The following article will discuss the most common coverages IMT offers for drivers.

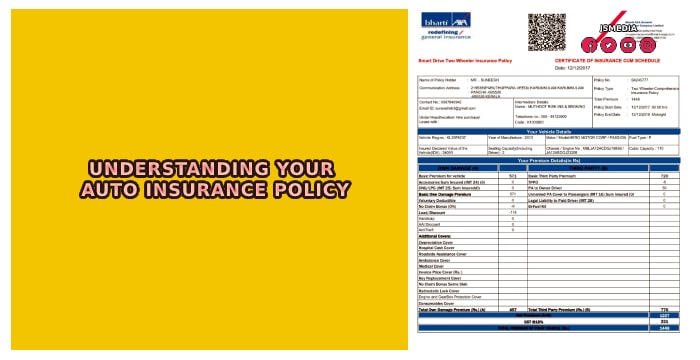

The policy contains specific details about coverage, payment and deductible amounts. It is also essential to understand your policy’s definitions section, which explains what each term means. In the declarations page, you’ll find information about deductible amounts, endorsements, discounts, and the insuring agreement. Read the definitions section, which lays out the different terms and conditions of each coverage. It will help you make a better decision regarding the type of coverage you need for your vehicle.

The policy is a legal document that outlines the payment and coverage terms. It contains a declarations page that includes basic information on your coverage. It also describes deductible amounts, endorsements, discounts, and insuring agreement. If you have any questions about your policy, contact an IMT Independent Insurance Agent today. The policy is intended to serve as a selection aid. It also lists specific exclusions and limits.

Understanding Your Auto Insurance Policy

The policy itself may contain endorsements, which are additional costs that should be included. The policy should state the cost of premiums and the deductible amounts. The policy also describes any additional benefits and services that you need. You should also review the coverage details and choose the one that fits your needs and your budget. When you have a policy, it is important to know what it covers and how much you have to pay for it.

The most important aspect of an auto insurance policy is the liability. The liability coverage protects you and the other driver. It also protects the driver and other vehicles in the event of a collision. In the event of a collision, the insurance company is responsible for paying for the other driver’s damages. A liability policy will protect you if the other party is at fault. A medical payments insurance cover pays for the costs incurred in treating an injured person.

In most cases, you can save money by getting the most comprehensive coverage available. It is essential that you understand the details of your policy before making any decisions about it. You should read the insurance policy carefully and be aware of any changes that you need to make. It should also cover any medical expenses. If you have an accident, you can claim compensation for the medical costs that are not covered by your insurance. If you are at fault, you will have to pay for the expenses yourself.

It is essential to understand your car insurance policy and its limitations. You should keep the most current copy in your car at all times. In fact, you should also carry a copy of the policy with you at all times. You must also read the insurance policy to determine your exact coverage and the amount you will be responsible for. It should include information regarding the other drivers and other people who are involved in the collision. In addition, the policy should include any special conditions for the accident.

The auto insurance policy is comprised of a number of different types of coverage. You should select a comprehensive policy if you need bodily injury protection, or only liability. While you should have bodily injury liability coverage, a comprehensive policy will cover damage to other people and properties. If you need this, choose a higher limit. You can also select a collision and comprehensive coverage plan. Once you have an understanding of the different types of auto insurance coverage, it will be easier to choose the right one for you.