JSMedia – In 2013, the Ontario Liberals promised to lower car insurance rates by 15 percent by the summer of 2015. That meant capping minor injury payouts and letting drivers buy less coverage. Then, they broke their promise, recasting the goal as a “stretch goal.” Now, they are threatening to take it back. Despite a strong mandate, the insurance industry is unimpressed.

But there are many positive changes in Ontario’s auto insurance system. First, the government is considering including tow trucks and roadside assistance services under the Commercial Vehicle Operator’s Registration system.

These measures are aimed at improving road safety and reducing crashes. The province is also looking into creating a special investigation unit to investigate serious fraud, which could include auto insurance scams. Mediation is currently mandatory for most disputes with auto insurers.

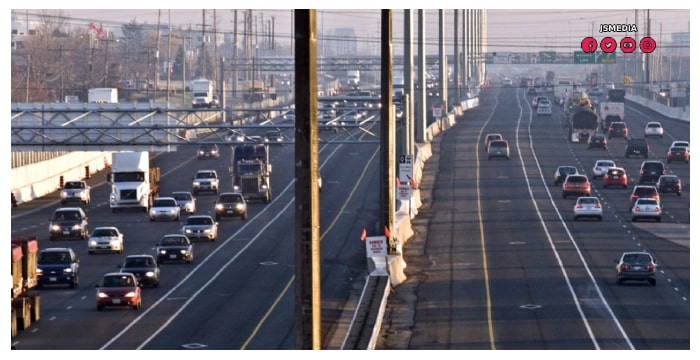

Ontario Aims to Cut Auto Insurance Rates by 15% by Summer 2015

A 15% rate cut is not enough, however. It’s not clear how much the reduction will affect individual drivers. The committee responsible for the plan has said that the best drivers will see the most immediate effect, but there are also other drivers who may have to wait longer for the reduction. That’s why it’s important to be proactive in your interactions with your insurance agent. By working with your agent, you’ll avoid making costly mistakes that could cost you a lot of money.

Despite the high-risk auto insurance market in Ontario, the government’s attempt to reduce premiums is not working. It has increased premiums over the past two years by a quarter of a percent. That’s not enough, and it’s time to make changes in order to lower them further. The province’s finance minister, Charles Sousa, said the government needs to work with insurers and the Insurance Bureau to make sure that consumers are getting the most affordable coverage.

After two years, Ontario drivers have seen an increase of 4.66% in their car insurance premiums. The decrease is more than double the rate of the previous year, and the average policyholders have had to pay a higher premium than the average driver. Currently, the highest premiums in Canada, but the province’s lowest accident and fatality rates. The government’s new policy is a welcome change, but it is unlikely to make a big difference for the average consumer.

Ontario has a new law to regulate the insurance industry. The law requires the province to create an independent regulator that regulates the insurance industry. This new regulator should be separate from the Office of Financial Services. This would help protect consumers and reduce costs for all. The reforms are necessary if the government wants to cut auto insurance rates. And a strong, independent regulatory body is essential to keep the system in order.