JSMedia – When it comes to digital Auto insurance, Nationwide is looking for ways to increase transparency and reach millennial consumers. Although Spire is not the first company to launch a digital platform for auto insurance, it is the first large corporation to do so. Geico and Allstate both have launched mobile-oriented apps for their customers. And now, Nationwide is eyeing the future. This is where the company will be heading.

As a member of the Eyes Rollout for Spire, you will be able to buy auto insurance online by scanning your driver’s license and answering four questions about your driving habits. You don’t even need to speak to an agent. You’ll get clear premiums without the industry’s jargon. The company plans to expand the product line and offer more products and services to its customers.

To launch Spire, the company plans to make it as simple as possible for customers. The company will initially only offer auto insurance through the platform, but will eventually offer a variety of other products and services.

Nationwide Eyes Rollout for Spire a Digital Auto Insurance

Through the app, customers will be able to apply for auto insurance by scanning their driver’s license. This process can take as little as a minute, which is a significant time savings.

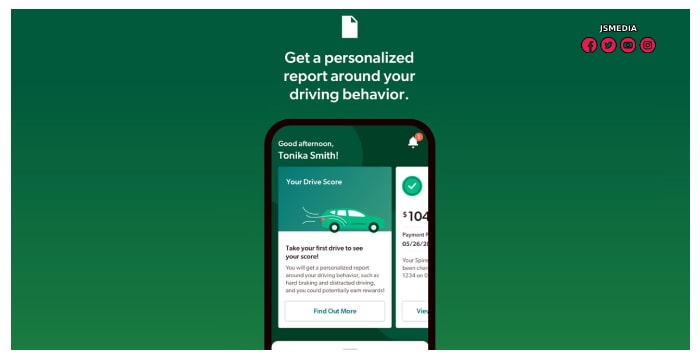

The new platform will help customers cancel their existing auto insurance policies, manage their Spire coverage, and file claims. With its telematics component, Spire will monitor customers’ driving habits and behavior. The idea is to use Spire as a reward program and a “stick” for customers who are not happy with their current auto insurance policies. Ultimately, it will be up to the customer to determine if it is the right fit for them.

With the advent of new technologies, insurance companies can innovate faster. With a digital auto insurance system, users will only need a standard driver’s license and answers to four basic questions. The process could take as little as 90 seconds to complete. The new system, Spire, is the next step for a digital auto insurance. Socotra is an excellent choice for a large company like Nationwide, and it can help them build and launch new products quickly.

One of the most impressive benefits of a digital auto insurance is that it allows consumers to pay with a tap of their smartphone. The app is easy to use and the app is user-friendly, making it an ideal solution for drivers with a busy schedules. With its simple claims filing and other features, Spire is a digital auto insurance that can meet the needs of the most diverse customers.