JSMedia – A Kemper Auto Insurance Review is necessary to get a better understanding of the company’s capabilities and customer service. This auto insurance provider offers cheap rates to drivers with clean driving records, but their lack of telematics program and sparse website could lead some consumers to think twice. If you’re looking for a comprehensive policy, you should consider other options before settling for Kemper. But for families, this company has something to offer. It has affordable policies for young drivers, and teen drivers can even get discounts for safety classes.

In addition to offering affordable premiums, Kemper offers enhanced coverage, such as a retro loyalty discount based on how long you’ve been a customer. The company’s Safe & Sound(r) discount is a valuable perk for those who have two named drivers and one over the age of eighteen. Customers are also eligible for discounts for having an accident-free driving record and electronic signatures. Lastly, seniors can get automatic payments, which make it even easier to make monthly payments.

The good news is that Kemper is very flexible with its payment options. It offers several payment plans. For example, you can pay monthly instead of monthly.

Kemper Auto Insurance, A Good Capabilities and Customer Service

If you can pay your premiums in full, you can receive an additional discount. Or, if you don’t have the money to make an initial payment, you can choose a monthly payment plan. A monthly payment plan is also available. It is possible to qualify for a down payment of one month’s premium, which will significantly lower your insurance cost.

The good news for Kemper is that it offers a standard auto insurance package. You can choose between basic coverage and optional packages. This is an affordable option for families who need car insurance coverage for teens. It also provides comprehensive coverage. Its customer service is also excellent, although some customers have complained about rude agents. Regardless of the positives, Kemper is a dependable option for teens and families. If you’re looking for a reliable and affordable policy, consider getting a quote from a local agent or using the online platform.

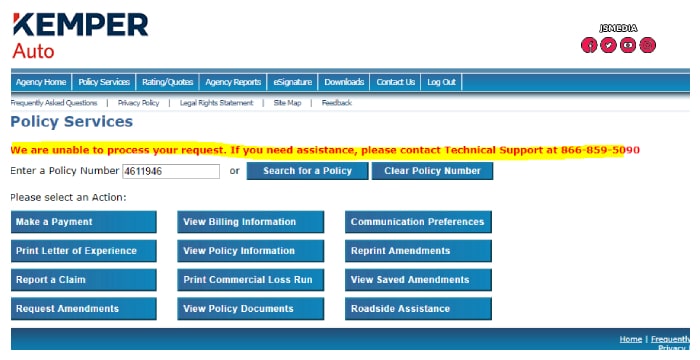

The official website of Kemper is easy to navigate and offers typical auto insurance coverage. You can compare quotes and prices online, or contact an independent agent to find the best one. Both types of insurance will cover damages and injuries in car accidents, and both types are important. You can even choose full coverage to insure a teen and a family. You can choose to pay for both types of coverage if you have enough money.

The company’s extensive selection of automobile insurance products makes it a strong choice for a family. Its nationwide reach, large amount of coverage in force, and strong financial outlook make it an excellent choice for individuals looking for an affordable insurance plan. Its credit rating with A.M. Best is “A-,” which means that it is a good choice for customers who are looking for the best insurance. Its A- rating is a strong indicator of the company’s stability and reliability.

In the J.D. Power 2020 U.S. Auto Insurance StudySM, Kemper received a rating below other California companies in terms of customer satisfaction. While this is an excellent result, it does not fare well in other states. In addition, it has few complaints compared to its competitors. Its complaints index was 2.08 in 2018, but it rose to 3.79 in 2019 and 6.42 in 2020. It is also important to note that Kemper has good customer service. However, its lack of service quality could make it a less attractive option for most customers.

Another benefit of Kemper’s auto insurance is its competitive rates. It offers a variety of coverage packages for low-cost cars. Its non-standard policies are particularly useful for those who want a more customized policy. Some of its policies are designed for high-risk drivers, but the company also offers pet protection and accident forgiveness. For California residents, Kemper offers several discounts, including those for drivers with a bad driving record.