JSMedia – The first step in understanding your auto insurance is to understand the terms and conditions of your policy. This document lays out the responsibilities of you and your insurer when filing claims, and will also outline the conditions that can affect cancellation of the policy. These conditions may be changed in certain circumstances, and you will have to give sufficient advance notice to your insurance provider to cancel your policy. To learn more about the coverage provided by your policy, read its terms and conditions and get a copy of the insurance contract.

Usually, auto insurance policies will have deductibles and excess payments. These are amounts you must pay on your own when filing a claim. If you’ve never had an accident, you’ll have to pay the deductible amount in full. The higher the deductible, the less you’ll have to pay in premiums. On the other hand, if you’ve had an accident and have to make an expensive claim, you’ll have to pay more for the insurance.

You’ll need to provide some personal information to get started. The state you live in will need to approve a policy based on your personal information. A few years ago, it was illegal to drive without auto insurance in most states. By law, you’ll need to be insured with an insurance company that’s licensed to operate in your state. Your insurance company will pay you if you cause an accident and you’re at fault. However, liability coverage is a one-way street. It’s not necessary to purchase full coverage if you’re driving an SUV or a pickup truck, and you should not have a liability policy.

Auto Insurance Explained: How to Get Cheap Online Auto Insurance Quotes

Your auto insurance policy will contain the insuring agreement. This outlines your obligations to your insurance company. The insuring agreement will also state who is covered. This will list the people named on your declarations page. If you’re an Uber driver, you should purchase rideshare insurance. As a first-time car buyer, you should understand the seven basic types of automobile insurance. You should not drive without proper coverage.

The next step in auto insurance is determining how much coverage you need. There are several types of coverage, including liability, medical payments, and collision coverage. Each type of coverage will have its own premium. In general, you should buy minimum limits for all these types of coverage, but you should not forget to take into account your personal situation. Moreover, auto insurance covers many aspects of your life. This is why it’s important to understand the ins and outs of auto insurance.

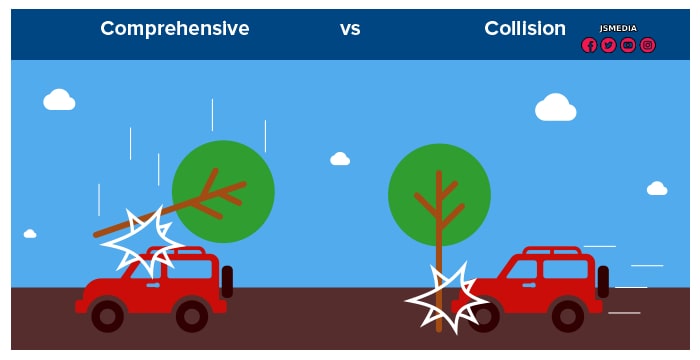

Choosing the right type of auto insurance policy is a key part of your financial health. The first step is to consider the type of coverage that fits your needs and budget. You can choose between different types of coverage according to your needs and budget. Comprehensive coverage covers damages that occur due to accidents or natural disasters. This is especially important if you live in an area where crime is a major problem. You’ll need more than just liability insurance to cover damages in accidents.

The second step in choosing an auto insurance policy is to compare the types of coverage. This will ensure that you are getting the best possible value for your money. You should be able to compare the cost of various policies and choose the one that meets your budget. If you want to save money, consider getting a comprehensive policy that covers all your needs. This will ensure that you’ll have a great policy for your needs. And remember, your auto insurance policy is not a waste of money if you don’t use it wisely.

Besides the basic coverage, there are also other types of coverage. In addition to liability insurance, you should also consider other types of insurance. Purchasing liability insurance is essential, as it protects you from lawsuits by negligent drivers. You should make sure that the coverage you purchase covers these factors. Otherwise, your policy may be worthless. For instance, collision coverage covers only damages caused by an accident. Property damage liability coverage pays for damages caused by another motorist.