JSMedia – Most insurance companies in the United States are no-fault, meaning that the at-fault party has to pay for the losses of the other driver through their insurance company. This means that drivers in Los Angeles can expect to pay much more than the average car insurance rate for drivers in California. While the average premium for car insurance in Los Angeles is still pretty low, there are some factors to consider. Here are some of the most important factors that affect your auto insurance premium:

If you live in a high-risk area, your car insurance premium will probably be higher. This is because of the number of uninsured motorists, crime rates, and the density of people. In areas where these factors are high, premiums tend to be higher.

Generally speaking, full-coverage insurance is cheaper than minimum coverage. However, it’s wise to increase your liability coverage limits to ensure that you have additional coverage in the event of an accident.

Brace Yourself For Higher Auto Insurance Companies Rates

Various factors affect your auto insurance rate. These include the age of the driver, location, and driving history. It’s important to review your policy thoroughly before deciding on the insurer to avoid any surprise. Besides knowing your coverage, you should also take the time to compare different Los Angeles auto insurance companies. This way, you’ll have an idea of which ones are best for you and which are the most affordable.

When choosing an auto insurance company in Los Angeles, you should keep in mind your driving history. While your age is a factor in determining your premium, you can also lower your premium by avoiding high-risk neighborhoods. The higher the number of accidents on your driving record, the more expensive your car insurance will be. If your car is in bad shape, you should opt for a low-risk neighborhood.

When selecting an insurer, consider your age and location. Certain neighborhoods have higher crime rates than others, which means that insurers are more likely to charge you a higher rate. Depending on where you live, you can find the best deal in Los Angeles by comparing the top 10 ZIP codes in the city. The age and location of a vehicle can affect your auto insurance rates. If you are a younger driver, you may have to pay more for your coverage.

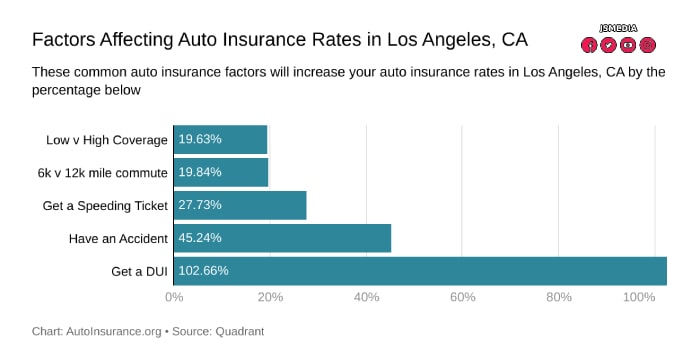

If you have a clean driving record and no accidents, you can expect to pay slightly higher rates for car insurance. The costs of car insurance in Los Angeles are higher for drivers with at-fault accidents. A driver with a DUI is more likely to pay more than a driver with a clean driving record. In addition, it is not uncommon for insurance companies to request detailed information about an accident, even if the other party was at fault.