JSMedia – You can use an auto insurance quote comparison tool to find the best rates on car insurance. However, you need to remember that an auto insurance quote comparison tool does not provide a specific estimate of the cost of a policy. It only shows you examples of different quotes. These examples might not be appropriate for your situation. Moreover, you may have a policy with a company that is not listed in the guide. Using a comparison tool to compare quotes can help you save money on your car insurance.

The main benefit of using an auto insurance quote comparison tool is that you can get an idea of how much the various insurance companies will charge you. Most insurers will offer a discount if you pay in full at the time of purchase. You can also compare the different policies on a monthly or yearly basis. The quotes should include discounts and other incentives. For example, many insurers offer a discount for paying in full upfront.

A car insurance quote is just an estimate of how much you will pay. It is different from your policy rate. You can save money by comparing quotes from several companies and choosing the one with the best coverage. You can compare multiple quotes by entering your zip code. This will allow you to find the most competitive policy for your needs. It can be difficult to decide what kind of coverage you need, but using a car insurance quote comparison tool will make your job easier.

Auto Insurance Quote Comparison Tool, How to Find the Best Rates Online

When comparing car insurance quotes, you should also consider the history of your vehicle. Some companies charge higher rates for drivers with previous accidents, while others charge a lower rate for drivers without accidents. Insurers can also ask you about your driving history to help them offer you the best policy. Once you have the quotes in hand, you can choose the best one for you. You can weigh the total cost of the insurance policy, discounts applied to the rate, and the term of the policy. Most policies last six months or more, so you should be able to find the cheapest one for you.

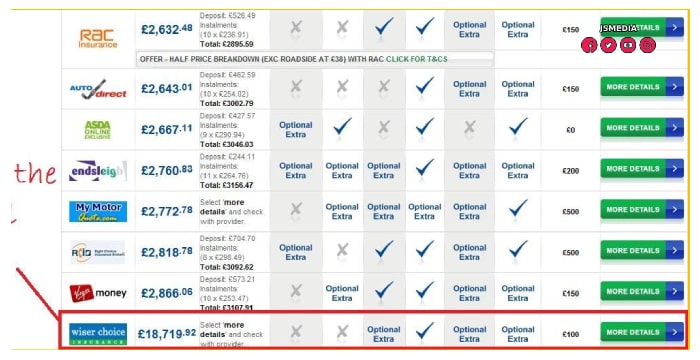

A good auto insurance quote comparison tool will allow you to compare rates from several different companies. It will show you the best and lowest quotes from up to six carriers. By comparing rates and premiums, you will be able to find the best policy at the most affordable price. There are many websites that can help you compare auto insurance rates, but the quality of their results will depend on your ZIP code and your driving habits. This is why you should make use of an auto insurance quote comparison tool.

It is important to note that the information provided by an auto insurance quote comparison tool may not be completely accurate. A good comparison website will provide the best quotes from each company. You should consider the discounts offered by different companies, which are the most important factors for choosing an affordable policy. When you use a comparison site, you should take time to review each quote. You should also check for the accuracy of the quotes. This way, you will know which company to choose and which one is best for you.

A car insurance quote comparison tool will display the minimum and maximum coverage levels required by your state. If you have a low income or are self-employed, it is best to use a comparison tool to compare the different quotes. Ensure that you have the minimum coverage requirements in your state to avoid having to worry about the costs in the future. If you have a young family, you will want to pay attention to all details before buying auto insurance.

You will be able to compare the deductibles in different insurance companies. A deductible is the amount that you need to pay before an insurance policy kicks in. You should also check the deductibles for teenagers, women, and senior citizens. The deductibles are an important factor in determining the cost of a policy. This is an important factor in ensuring that your insurance will not be underinsured.