JSMedia – In the United States, there are several different types of auto insurance coverage. Depending on your location, you may be required by law to carry a certain level of insurance. You may also need to meet requirements for your auto loan lender. However, even if you do not need a specific level of coverage, you may still want to purchase it. Understanding the different types of coverage is important.

Liability insurance is required by state law, but many drivers are uninsured. A recent study found that 12.6% of drivers did not have enough coverage. Underinsured motorist coverage can help you pay for damages, medical bills, and even pay for repair costs of your car. In some states, you can opt for uninsured/underinsured motorist coverage. While it is optional, it is essential if you are involved in a collision.

Another type of insurance is roadside assistance, which pays for towing services. Umbrella insurance provides additional liability coverage, which is useful for lawsuits after accidents.

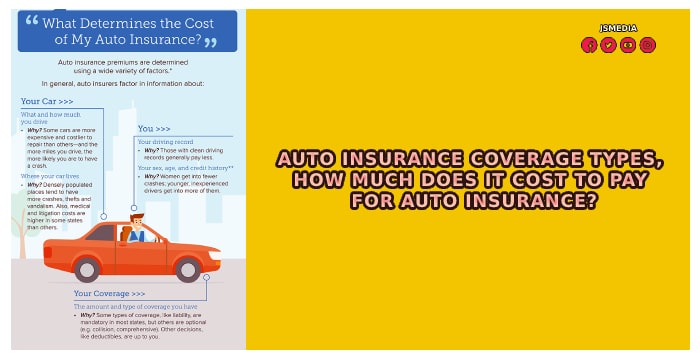

Auto Insurance Coverage Types, How Much Does It Cost To Pay For Auto Insurance?

Rental reimbursement coverage pays for transportation while your car is being fixed. Original equipment coverage will ensure that you only use parts manufactured by the manufacturer. Finally, collision coverage provides coverage for other cars in your car’s name if you are at fault in an accident.

Bodily injury liability insurance is required in most states. Depending on the state you live in, the amount of coverage you must have is higher or lower than the minimum legal requirements. Regardless of the type of insurance you purchase, make sure you have a comprehensive policy. It is a good idea to look for lower deductibles if you’re concerned about your credit history. You can still get car insurance for less if you have poor credit.

Liability insurance is the most basic type of auto insurance. This type of coverage covers the other driver’s assets, so if you were to be at fault in a crash, you’d be reimbursed. If you’re at fault in an accident, this can be a significant problem. The deductible, or how much you pay for the insurance, should be your deciding factor.

You can choose between comprehensive and collision insurance. If you’re able to afford a high deductible, you’ll pay less each month. If you don’t have much cash in your pocket, you can choose liability only. This will save you money in the long run. You can always increase your deductible to lower your monthly premium. If you don’t need these extras, you can always opt for a full coverage policy.