JSMedia – Recent discussions in British Columbia about insurance rates have focused on the fact that ICBC drivers pay the highest rates in Canada. This is a concern for young drivers, who have the highest costs to cover injuries and damages caused by accidents. ICBC says that the increase is due to a spike in their costs, including injury claims and lawsuits, as well as vehicle repair liabilities. However, the government has also proposed that it could lower rates by allowing private insurers to participate in the market.

One reason for the high rates is the monopoly enjoyed by ICBC. Without the rate cuts, ICBC would have lost over $2.5 billion in the next five years and is struggling to get back to break-even this year. ICBC blames its growing costs on rising claims, including $700 million in annual legal fees, which make up more than one quarter of their operating expenses.

ICBC’s monopoly on the basic rate system has contributed to the high cost of car insurance in BC. While this has been a factor for years, the latest changes to ICBC’s rating system indicate that drivers can save an average of $1,570 annually by choosing the most affordable plan.

Understanding Why Basic Auto Insurance Rates in BC Are So High

The government recently announced the reductions. ICBC argues that the increase in premiums is necessary to offset the growing costs of auto insurance. Its rates have increased by more than two thirds in the past five years, and the rise in premiums is the result of higher claims costs. Inexperienced and youth drivers faced higher costs due to increased legal fees. ICBC has also defended its rate cuts, which could save drivers $1,570 a year.

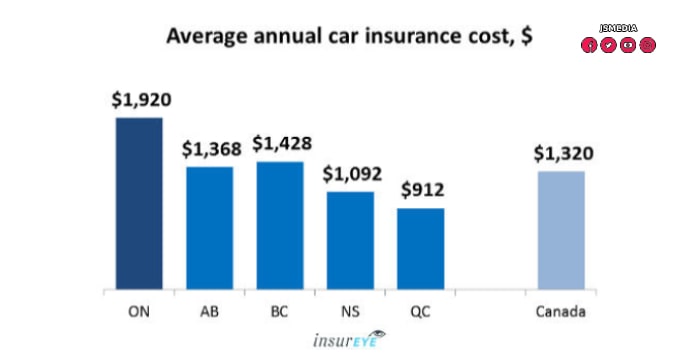

While there is no evidence that private companies will increase their rates, this does not mean that they are not working for you. While the ICBC’s new no-fault system aligns with the structure of Ontario and Manitoba, it still imposes costs on those who are not at fault. That’s why it’s important to compare prices from different provinces and find the most affordable one for you.

If you’re looking for a lower cost auto insurance, you may want to consider the provinces where rates are more affordable. In some cases, you can get a lower rate if you buy a cheaper policy. If you’re not comfortable with the higher rates, you can always purchase a more expensive policy that offers more coverage. It’s important to compare rates before you buy any type of insurance, but the price can vary from one province to another. It’s best to gather several quotes before making a decision.

The reason for high insurance rates in British Columbia can be complicated. There are many reasons that are behind the high costs. Some of the most common factors include fraud, a lack of competition, and a lack of government involvement in selling the insurance. It’s important to make sure you’re getting the right coverage for your needs. When you’re not sure what your needs are, you should look for an experienced broker to help you.